Nonprofit Resources

ASU 2016-14 and Schools: Qualitative Liquidity and Availability Disclosures

All schools that issue external financial statements (complete with footnote disclosures) for fiscal years beginning after December 15, 2017 (calendar year 2018 and fiscal years ending in 2019) are subject to the new nonprofit financial reporting requirements. However, as a best practice, even schools that don’t issue external financial statements should have a written cash management policy that could have content and attributes similar to these new qualitative disclosure requirements.

This article focuses on the additional qualitative or non-numerical disclosures required by ASU 2016-14. The ASU 2016-14 and Schools: Quantitative Liquidity and Availability Disclosure Considerations article provides information about the quantitative or numerical aspects of this disclosure.

Qualitative Disclosure Requirements

The ASU requires disclosure of essential qualitative information about the availability of your school’s financial assets at the Statement of Financial Position date to meet cash needs for general expenditures within one year of that date. This disclosure typically follows the quantitative or numerical sum total of available assets and adds additional written factors that explain how your school manages its liquid resources. The information for the disclosure usually comes from the school’s cash management policies and practices.

Best Practices for Cash and Liquidity Management

Here are some strategies and best practices CapinCrouse has seen schools use to manage their cash flows and liquidity effectively:

- Set up a balanced budget every year. This budget should be realistic and include required debt service obligations, even if the debt service is funded by restricted gifts. This is true even if your school has an operating deficit, so that the deficit doesn’t continue to grow.

- If your school has a cumulative operating deficit, you should do some long-term strategic planning and budgeting to erase this deficit over a targeted number of years. Keep in mind that it probably took several years to create the deficit so it may take multiple years to eliminate it.

- Develop a policy that requires the budget to be approved before the start of the new school year. (Note: After the school year starts and you know the number of enrolled students, you may need to adjust this approved budget accordingly.)

- If your school’s operating reserves are not funded adequately, set up an operating line of credit as a way to address your cash management policy. This is especially useful for schools impacted by this new ASU.

- Accumulate funded operating cash reserves to cover a minimum number of days of cash operating expenses. I recommend a minimum of 60 days or two month’s operating reserves as an initial target. Note: Operating reserves are calculated by taking 1/12th of annual cash expenses (total expenses less the largest noncash expense of depreciation) plus any funds needed to service operating debt. Operating debt consists of borrowed funds that have been used in operations versus to acquire property and equipment.

- Also, accumulate other funded cash reserves for anticipated upcoming expenditures for fixed asset purchases (capital), major repair and maintenance (roof, parking lot, HVAC), and other future ministry programs or projects included in the school’s five-year strategic plan.

- Establish a practice of having any board-designated funds formally approved in the school minutes when they are established. For example, any board-designated funds disclosed in the fiscal year 2018 external financial statements and any new funds established in fiscal year 2019 would need to be formally approved in the school minutes when established. If any existing board-designated funds have not been formally approved, we recommend this be done before the end of fiscal year 2019.

- If cash flows allow, develop a strategy to pay off existing debt ahead of schedule.

- Long-term goals should include reversing any existing operating deficits and establishing endowment funds.

These policies and practices form the basis for the new qualitative disclosures below.

Disclosure Examples

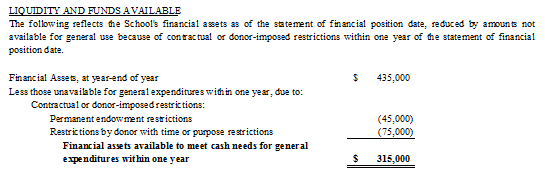

Figure 1 shows a sample quantitative disclosure for a school that does not have board-designated funds:

Figure 1

Here is a sample qualitative paragraph that may accompany this chart:

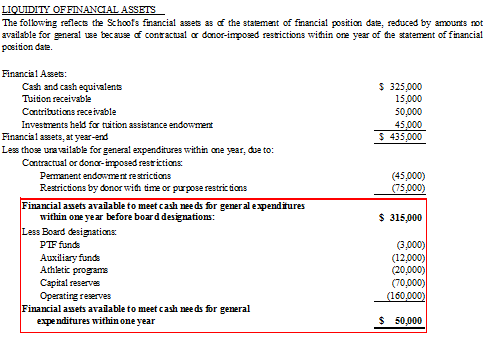

In the example above, the school does not have board-designated reserves. In ASU 2016-14 and Schools: Quantitative Liquidity and Availability Disclosure Considerations, we discussed the impact of board-designated reserves on this total and the fact that the ending total is reduced by these board designations. We recommended adding a subtotal before the board designations, as shown in Figure 2:

Figure 2

The qualitative paragraph could then refer to the subtotal line to make it easier for the reader to understand your school’s financial position, as follows:

The School is substantially supported by tuition and fees. The School is also supported by contributions on an unrestricted and restricted basis. Those contributions with donor restriction require resources to be used in a particular manner or in a future period. The School must maintain sufficient resources to meet those responsibilities to its donors. Thus, financial assets may not be available for general expenditure within one year. As part of the School’s liquidity management, it has a policy to structure its financial assets to be available as its general expenditures, liabilities, and other obligations come due. Another part of this policy is the board’s approval of the annual balanced budget in [Month] [Year]. The School also has established guidelines for making decisions related to managing short-term cash reserves and other investments in a prudent manner. Management has set ## weeks of expenses as a reasonable cash reserve on an ongoing basis.

Occasionally, the board designates a portion of any operating surplus to its operating reserves, which totaled $160,000 as of July 31, 201X. The sub-total “Financial assets available to meet cash needs for general expenditures within one year before board designations” represents another liquidity total, as board-designated reserves can be reversed and made available for immediate use in the event of an urgent liquidity need. The school could also draw upon a $150,000 available operating line of credit (as further discussed in Note XX).

Operating Lines of Credit as Additional Liquidity Sources

Some schools carry operating lines of credit as additional sources of liquidity even if the school does not have the intention to draw from the line. These extra liquidity sources would be explained in the qualitative section of the disclosure as follows:

Or:

It’s important to note that your school should not use the new disclosure amount to measure operating reserves.

If your school hasn’t thought about how the liquidity disclosures will look in the footnotes, now is the time so you can consider these factors before the end of the fiscal year of the ASU adoption.

This article first appeared in the Association of Christian Schools International (ACSI) Legal/Legislative Update, Winter 2018.

Richard Lindley

Richard has managed audit, review, and compilation engagements for more than 20 years and provides church and other nonprofit consulting services in a variety of areas. He is a member of the firm’s Church and Denominational Team and helped draft the CapinCrouse Church Financial Health Index™ and CapinCrouse Church Checkup™ and related reports. Richard frequently authors church articles. He also serves as his church’s finance ministry leader.