Nonprofit Resources

Private Higher Education Pandemic Update

These local and regional institutions are uniquely positioned to navigate the pandemic. Let’s take a look at the current trends and factors private higher education institutions are facing.

Operating Plans

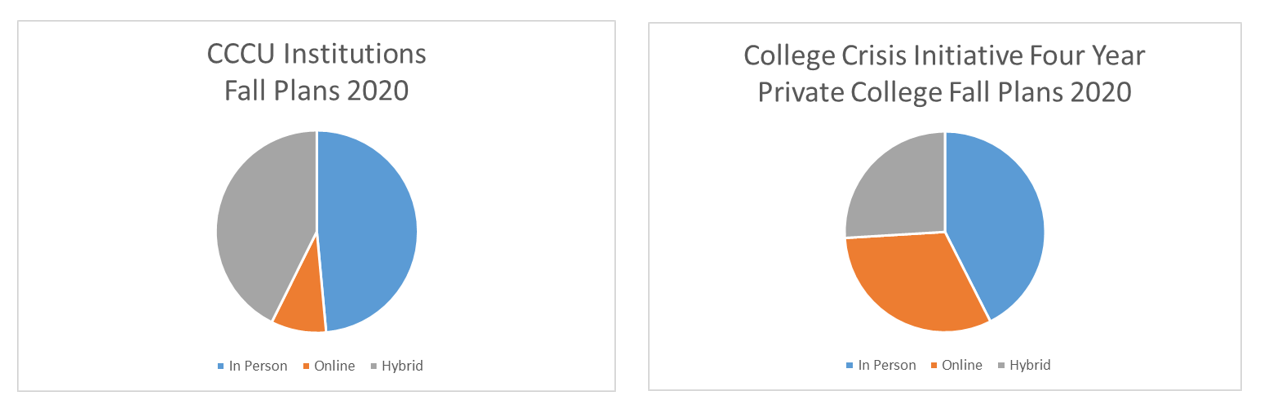

Of the 180 Christian private nonprofit higher education institutions around the world that are members of the Council for Christian Colleges & Universities (CCCU), including more than 150 in the U.S. and Canada, the majority were planning to reopen for residential on-campus learning experiences this fall. According to an analysis by The Chronicle of Higher Education and a review of institutional websites, 66 CCCU members report a commitment to primarily in-person instruction for the fall term 2020, with another 58 adopting a hybrid model. Twelve member institutions reported fall 2020 instruction would be provided primarily online, including eight members located in California.

The College Crisis Initiative @Davidson College (C2i) reports 313 private four-year nonprofit colleges and universities will deliver instruction primarily or fully in-person for the fall term 2020. A hybrid approach will be used at 191 four-year private institutions and 232 are showing as primarily or fully online.

The effect of the pandemic on enrollments will likely be as varied as approaches to instruction.

Sports Programs

Tuition-driven institutions have been adding sports programs to bolster enrollment since the 2008 recession. Many participants in NCAA D2 and D3 programs have more than 10% of their student body participating in intercollegiate sports activities. The National Association of Intercollegiate Athletics (NAIA) Membership Profile indicates the average number of student athletes is more than 20% of the student body.

The pandemic has resulted in suspended, postponed, or canceled fall seasons and championships for all but the largest conferences. Disrupted sports programs and seasons are likely to impact 2020 – 2021 enrollment and operational budgets.

C2i includes 293 institutions in its NCAA D2 filter. Of those, 104 have fall reopening plans that include primarily in-person (95) or fully in-person (9) instruction, and 80 will be primarily online (65) or fully online (15). The NCAA has canceled its fall Division 2 and 3 championships and is working to hold its fall sports championships in the spring.

The smallest private colleges could be impacted the most. The Chronicle of Higher Education recently cited data from Willis Jones, an associate professor of higher education at the University of South Florida, showing that 20% of enrolled students at NCAA D3 institutions participate in athletics.

Credit Ratings

Moody’s Investors Service began 2020 with a stable outlook for higher education, pointing to expected revenue growth of 3% to 4% in the sector. Expectations for small public and private universities were less robust at 2% to 3% projected revenue growth. An extended period of good investment returns was credited for an accumulation of expendable reserves in the sector.

However, Moody’s downgraded its industry outlook to negative on March 18, saying that as many as 30% of colleges and universities were experiencing weak operating performance prior to the pandemic. The credit rating agency indicated that it would take a financial market recovery and “robust enrollment in the coming fall semester” for it to upgrade the industry to stable.

S&P Global Ratings began 2020 with a negative outlook on private nonprofit higher education. The ratings organization indicated that there were more potential disruptions to credit than favorable opportunities. S&P pointed to a shrinking pool of high school students and economic growth forecasts of less than 2% as operating risks.

Fitch Ratings also began the year with a negative outlook for colleges and universities. In June 2020, Fitch reported that enrollment declines could range from 5% to 20% for many institutions in the fall of 2020 because of the coronavirus pandemic. The ratings agency concluded that private colleges could experience a more significant impact than public institutions due to a higher reliance on tuition and fees. Fitch reported median student share of total revenues at 82% for privates as compared to 38% for public institutions. Expected family contributions are likely to decrease due to the pandemic’s impact on the economy. This will put pressure on institutions to provide more institutional aid.

Fall 2020 and spring 2021 enrollments will significantly affect the long-term financial health of the higher education sector and the individual institutions in that sector.

Financial Markets

The impact of the coronavirus on financial markets began in February of 2020. Rich valuations were sent plunging as news of the fast-spreading virus offset the effect of positive earnings results during the fourth quarter of 2019 and January 2020. Global equities fell 34% in 35 days.*

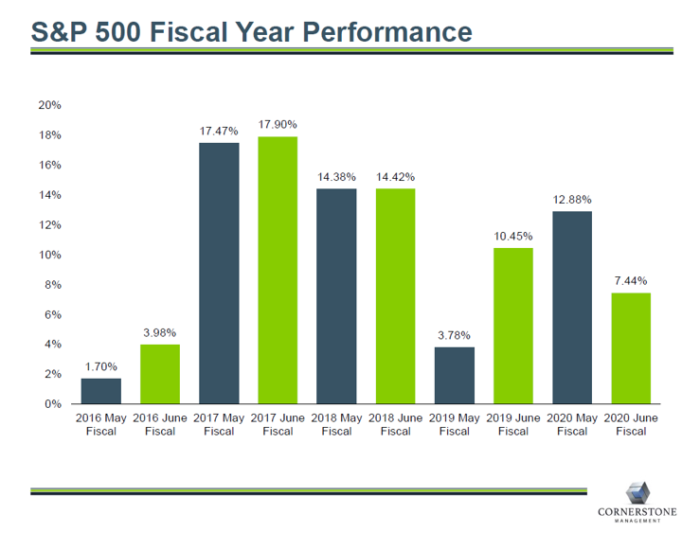

The rebound in equity values has been equally astonishing. Global equities rebounded 38% by mid-June. However, volatility remains in the financial markets and should be considered in budgeting and financial modeling. This chart provided by Cornerstone Management illustrates the effect one month’s volatility can have on an entire fiscal year’s returns:

Uniform Guidance News

The 2019 OMB Compliance Supplement section related to Federal Student Aid programs requires audit testing and reporting on Gramm-Leach-Bliley Act (GLBA) compliance. GLBA, also known as the Financial Modernization Act of 1999, was designed to require institutions originating student loans to detail how the institution protects students’ personal identification information. There are several components of the GLBA, including the Safeguards Rule. The Safeguards Rule requires institutions to take the following actions to protect this non-public personal information:

- Develop, implement, and maintain a written information security program;

- Designate the employee(s) responsible for coordinating the information security program;

- Identify and assess risks to customer information;

- Design and implement an information safeguards program;

- Select appropriate service providers that are capable of maintaining appropriate safeguards; and

- Periodically evaluate and update their security program

On February 28, 2020, the U.S. Department of Education (ED) issued an electronic announcement regarding its enforcement of cybersecurity requirements under the Gramm-Leach Bliley Act (GLBA). The enforcement of these requirements includes referrals to the Federal Trade Commission (FTC), as well as potential fines and other administrative actions by ED.

GLBA is one of two current business risks related to the financial aid office. Read Business Risks from the Student Financial Aid Office for details and some practical steps you can take to mitigate those risks.

The 2020 OMB Compliance Supplement was released in August 2020. This supplement is effective for June 30, 2020 Uniform Guidance audits and later. Changes include the testing of a student’s authorization to hold Title IV credit balances; student program enrollment detail reported to NSLDS; and reporting of permanent address changes to NSLDS. COVID-19-specific requirements are expected to be published as an addendum to the supplement in early fall of 2020.

Maximizing Outcomes

These trends and issues are much to navigate, but awareness is the first step, followed by careful consideration and planning.

Please contact us with any questions or if you would like to discuss how our higher education services can empower your institution. Our team of dedicated higher education specialists is experienced in industry best practices and can help you assess situations, identify opportunities, and maximize outcomes.

This was first published in the September 2020 Association of Business Administrators of Christian Colleges (ABACC) newsletter.

*Morgan Stanley Capital Index All Country World Index Net

Dan Campbell

Dan serves as Partner and Higher Education Services Director at CapinCrouse. Dan has more than 35 years of public accounting experience leading audit engagements of nonprofit organizations and for-profit industries. He leads the firm’s higher education practice segment, which includes more than 80 client relationships, and commits a significant portion of his professional time to board training, strategic planning initiatives, and accreditation support. He served on the Board of Trustees of Davis College for 25 years. Prior to joining the firm in 2006, Dan managed audits of financial institutions, construction contractors, and manufacturers.